Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Nearshoring is reshaping global trade. Discover how Indian textile, leather & handicraft exporters can capitalize on supply chain shifts by 2026.

The phone call came at 9 PM on a Tuesday. A longtime buyer from California, someone who’d sourced textiles from our Kanpur partners for eight years, was asking difficult questions: “Can you match Mexico’s delivery times? What about your tariff situation? How quickly can you pivot production?”

He wasn’t threatening to leave. He was genuinely torn. This conversation, repeated thousands of times across India’s export sector, signals the biggest shift in global trade since China joined the WTO in 2001.

At Lord Export Import, we’ve fielded hundreds of similar inquiries over the past six months. The nearshoring wave isn’t coming it’s already here. And it’s forcing every Indian exporter to answer a fundamental question: Where do we fit in the new global supply chain?

Recent Bain & Company research reveals a stunning statistic: 81% of CEOs and COOs now report plans to bring supply chains closer to market—up from 63% just two years ago. This isn’t gradual evolution; it’s rapid transformation.

More telling: The proportion of companies seeking to reduce dependence on China has risen to 69% in 2024, from 55% in 2022. That’s a 25% increase in just two years.

But here’s what the headlines miss: This isn’t about abandoning Asia, it’s about diversifying Asia. And India sits right at the center of this opportunity.

Nearly half of all U.S. businesses plan to increase nearshoring volumes in 2025, with Latin America becoming the poster child for this shift. Mexico is now America’s top import source, surpassing China. In Q2 2025, inspection and audit demand in Latin America grew 15% year-over-year, driven by North American buyers.

The 2026 prediction? The companies that survive this shift won’t be those fighting the nearshoring tide they’ll be those who position themselves as the smart alternative.

Let me tell you about Rajiv, a textile manufacturer in Kanpur who supplies bed linens to U.S. retailers. In 2020, his production was humming. Then came the pandemic. Then came the Suez Canal blockage. Then came the Red Sea crisis.

Each disruption added weeks to delivery times. Each delay cost him customers. By 2024, his average delivery time from order to delivery was 87 days. His Mexican competitors? 32 days.

This pattern repeated globally. Recent data shows 86% of consumers now describe “fast” shipping as within two days. Same-day delivery expectations have become standard, with 80% of consumers expecting it and 30% expecting it free.

The math is brutal: A 40-foot container from India to Los Angeles takes 25-30 days. From Mexico? 5-7 days by truck.

Several forces are making nearshoring permanent:

Geopolitical Risk: With U.S.-China tensions persistent and tariffs reaching century highs on “Liberation Day” (April 2, 2025), diversification is no longer optional it’s survival.

Speed-to-Market: Fashion cycles that once lasted seasons now last weeks. By the time Indian-made products arrive, trends have moved on.

Rising Labor Costs: China’s middle class emerged, and wages rose. India offers cost advantages, but so does Vietnam, Bangladesh, and increasingly automated Mexican facilities.

Sustainability Pressure: Shorter supply chains mean lower carbon footprints. European buyers increasingly demand emissions accounting, and a 15,000-mile journey looks bad on sustainability reports.

Here’s the uncomfortable reality: India is not winning the nearshoring race to serve North American markets. U.S. demand for inspections and audits in Latin and South America declined only 9% YoY in Q2 2025 a temporary dip amid tariff uncertainty, not a reversal of the broader trend.

Meanwhile, Mexico remains the foremost sourcing market for North American companies. Despite high U.S. interest in nearshoring, actual implementation through Asian partners has lagged.

But India has a different ace to play.

While Mexico captures North American textile orders, India is perfectly positioned for Europe, the Middle East, and Africa. European inspection demand in Mediterranean sourcing hubs surged in Q2 2025: Morocco up 53% YoY, Egypt up 73%, Tunisia up 35%.

The 2026 opportunity: As brands diversify away from traditional regions, India can become the anchor supplier for non-American markets while maintaining niche presence in the U.S. for products where speed matters less than craftsmanship and cost.

At Lord Export Import, we’ve deliberately pivoted our strategy. Rather than fighting for commodity textile orders against Mexico, we’re positioning our Kanpur partners for high-value European markets, Gulf construction projects, and African growth opportunities.

Must Read: The Soul Behind the Stitch: Textiles from India That Speak Global

Everyone focuses on India’s disadvantages—distance, infrastructure, bureaucracy. But several factors make India uniquely positioned for 2026:

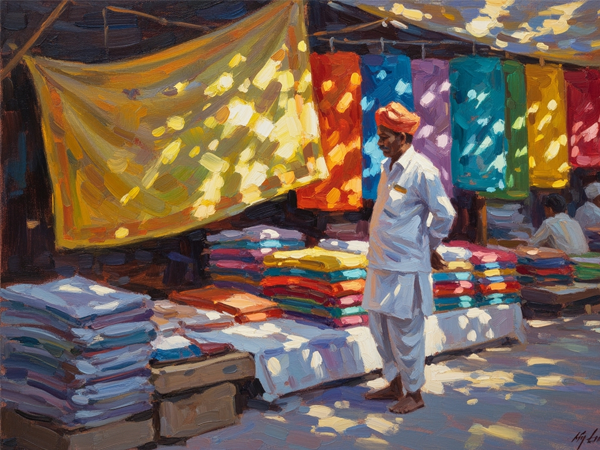

Scale and Diversity: No other country can match India’s breadth. Textiles from Kanpur, leather from Agra, handicrafts from Rajasthan, construction materials from everywhere. Lord Export Import works with 150+ manufacturers across categories. That diversification is rare.

Quality Craftsmanship: Mexican factories excel at high-volume, standardized production. But hand-woven textiles, intricate leather work, traditional handicrafts? India remains unmatched. A heritage hotel in Dubai recently chose Indian suppliers specifically because machines couldn’t replicate the artisan touch.

Price Competitiveness: Despite Mexico’s proximity advantage, Indian manufacturing costs remain 20-30% lower for many categories. For price-sensitive buyers, that math still works.

English Proficiency and Business Compatibility: Underrated but crucial. Indian exporters communicate more easily with Western buyers than many alternatives. Cultural understanding of Western business practices matters more than people admit.

Government Support: Production-Linked Incentive schemes, infrastructure investments, and export promotion programs are making India more competitive. Not fast enough, perhaps, but the trajectory is right.

Let me paint two scenarios:

Scenario 1 – The Losers: Indian exporters who continue competing head-to-head with nearshoring for commodity products to North America. They’ll match prices by cutting margins, watch volumes shrink, and slowly bleed market share. By 2026, many will have exited the business.

Scenario 2 – The Winners: Indian exporters who pivot to:

The winners will also adopt technology ruthlessly. A recent Capgemini survey found 56% of executives plan to nearshore or combine strategies in 2025. The 44% who don’t? They’re integrating AI, automation, and digital tools to compete on efficiency rather than proximity.

Lord Export Import‘s recent investment in AI-powered logistics optimization reduced our average delivery time to European markets by 23%. We can’t match Mexico’s proximity to the U.S., but we can be as fast as anyone serving Europe.

1. Geographic Pivot: Stop viewing America as the only major market. Europe’s $14.6 billion in green energy product imports alone represents massive opportunity. Africa’s fastest-growing import markets are in our backyard. The Gulf’s construction boom needs materials we produce.

2. Move Up the Value Chain: Commodity textiles lose to nearshoring. Sustainable textiles, organic cotton, artisan handicrafts, custom leather goods—these differentiated products command premiums that justify longer shipping.

3. Speed Where It Matters: Can’t beat nearshoring on speed everywhere? Choose your battles. Use air freight for samples and urgent orders. Maintain ready stock in European warehouses through consignment arrangements. Invest in digital tools that reduce order-to-production time even if shipping time stays constant.

4. Build Resilience: 81% of companies are bringing supply chains closer to market, but they’re also diversifying suppliers. Be the reliable backup supplier. When nearshoring partners face Mexican labor disputes or Central American weather disasters, you’re the steady alternative.

5. Go Digital: Cross-border e-commerce is exploding. The U.S. market alone was valued at $249.8 billion in 2024, growing at 23.7% CAGR. Platforms like Amazon Global, Alibaba, and IndiaMART level the playing field. A handicraft maker in Uttar Pradesh can reach buyers in Sweden as easily as a Mexican manufacturer.

Amit runs a mid-sized textile unit in Kanpur that employed 200 workers. In 2023, he lost three major U.S. accounts to Mexican suppliers. His revenue dropped 35%.

Instead of cutting prices to compete, he made five moves:

By mid-2025, his revenue had recovered to 2022 levels. His average order value was up 45% because European buyers pay premiums for certified sustainable textiles. His profit margins actually improved despite losing the U.S. accounts.

The lesson: Nearshoring to Mexico made him non-competitive for U.S. commodity textiles. But it opened his eyes to better opportunities elsewhere.

Based on current trends and conversations with buyers, here’s what Indian exporters will face in 2026:

Prediction 1: North American market share for Indian textiles will decline another 8-12%, with most losses in commodity categories. But Indian premium and artisan products will grow 15-20%.

Prediction 2: European demand for Indian exports will surge 18-25%, driven by diversification away from China and growing sustainability requirements that favor Indian manufacturers.

Prediction 3: Middle Eastern and African markets will grow 30-40% for Indian construction materials, handicrafts, and textiles as these regions invest in infrastructure and hospitality.

Prediction 4: E-commerce will account for 35-40% of Indian export value by 2026, up from approximately 20% today. Direct-to-consumer exports will explode.

Prediction 5: Indian exporters who integrate AI logistics, digital marketing, and automated compliance will maintain profitability. Those who don’t will see margins compress to unsustainable levels.

Don’t wait until 2026 to adapt. Here’s what Lord Export Import recommends Indian exporters do in the next 90 days:

Days 1-30: Analyze your customer base. What percentage depends on proximity? What percentage values your specific capabilities? Identify accounts at nearshoring risk versus accounts where you have defensible advantages.

Days 31-60: Research alternative markets. Connect with trade promotion councils, attend virtual trade shows, explore B2B platforms for European, Middle Eastern, and African buyers. Talk to export houses like Lord Export Import about market opportunities you haven’t explored.

Days 61-90: Make one major operational improvement. Could be obtaining a sustainability certification, integrating AI logistics tools, listing on a new e-commerce platform, or investing in faster production processes. Don’t try to fix everything—make one meaningful change.

The nearshoring wave won’t sweep away Indian exports. But it will separate the strategically nimble from the strategically stuck.

In my grandfather’s generation, Indian exports succeeded by being cheapest. In my father’s generation, by being good enough. In our generation, success requires being strategically positioned in the right markets with the right products at the right time.

Lord Export Import is here to help navigate this transition. We’ve been in the export business long enough to remember when “Made in India” meant cheap and low-quality. We’ve worked hard to elevate that perception. Nearshoring is just the latest challenge. We’ve adapted before. We’ll adapt again.

The question is: Will you adapt with us?

Is nearshoring threatening your export business? Turn challenge into opportunity.

Lord Export Import specializes in helping Indian textile, leather, and handicraft manufacturers pivot to high-growth markets and high-value products. Our strategic approach has helped 50+ exporters not just survive nearshoring—but thrive despite it.

📧 Email: info@lordexportimport.com

🌐 Visit: www.lordexportimport.com